|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding the Refinance Fixed Home Loan ProcessRefinancing a fixed home loan can be a strategic financial move for many homeowners. Whether you're looking to reduce your monthly payments or tap into your home's equity, understanding the process is key. This article will guide you through the essential aspects of refinancing a fixed home loan. Benefits of RefinancingRefinancing can offer several potential benefits:

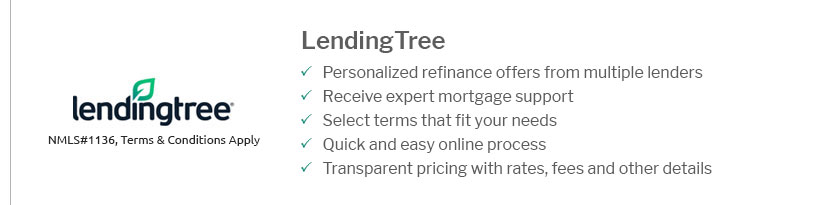

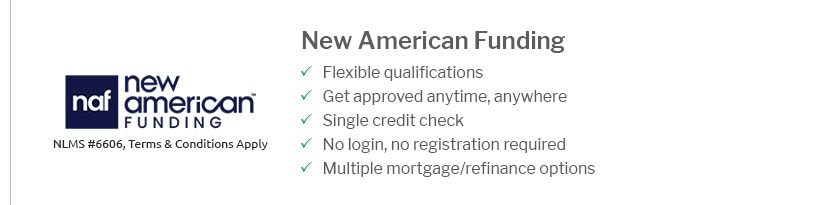

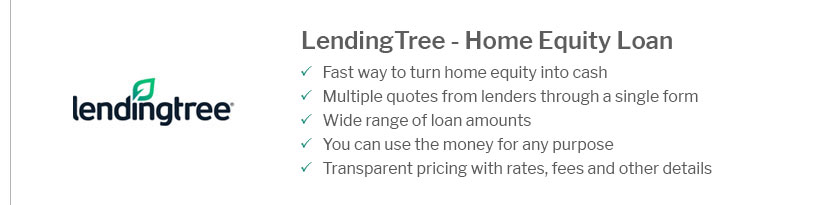

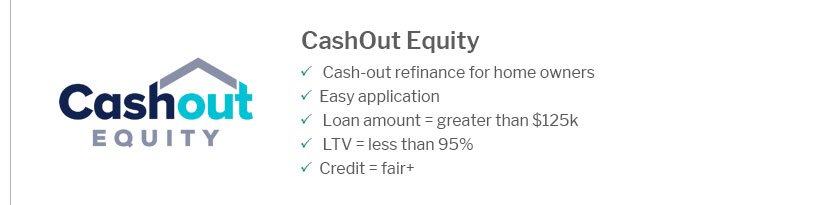

Steps to Refinance a Fixed Home LoanEvaluate Your Financial SituationBefore refinancing, assess your financial situation. Determine your credit score, debt-to-income ratio, and the current value of your home. Knowing these factors can help you decide if refinancing is a viable option. Research and Compare LendersResearching lenders is crucial. Compare interest rates, fees, and terms from multiple lenders. This can help you find the best deal that fits your financial goals. You might find it helpful to understand the cost to refinance a house to ensure you are prepared for any associated expenses. Potential Drawbacks of RefinancingWhile refinancing has benefits, there are also potential drawbacks:

Common Questions about RefinancingRefinancing a fixed home loan requires careful consideration and planning. By understanding the benefits and potential drawbacks, you can make an informed decision that aligns with your financial goals. https://www.reddit.com/r/personalfinance/comments/1arplge/can_you_still_refinance_on_fixed_house_loans/

Yes to both. If you get a fixed rate mortgage you get that rate for the entire term. You can refinance anytime you want but rates will be based ... https://www.miamiherald.com/banks/mortgage/refinance-fixed-rate-mortgage/

Yes, you can refinance a fixed rate mortgage. Refinancing involves replacing your existing mortgage with a new one, often to secure a lower ... https://www.zillow.com/refinance/

Additionally, the current national average 15-year fixed refinance rate remained stable at 6.00%. The current national average 5-year ARM refinance rate is up 1 ...

|

|---|